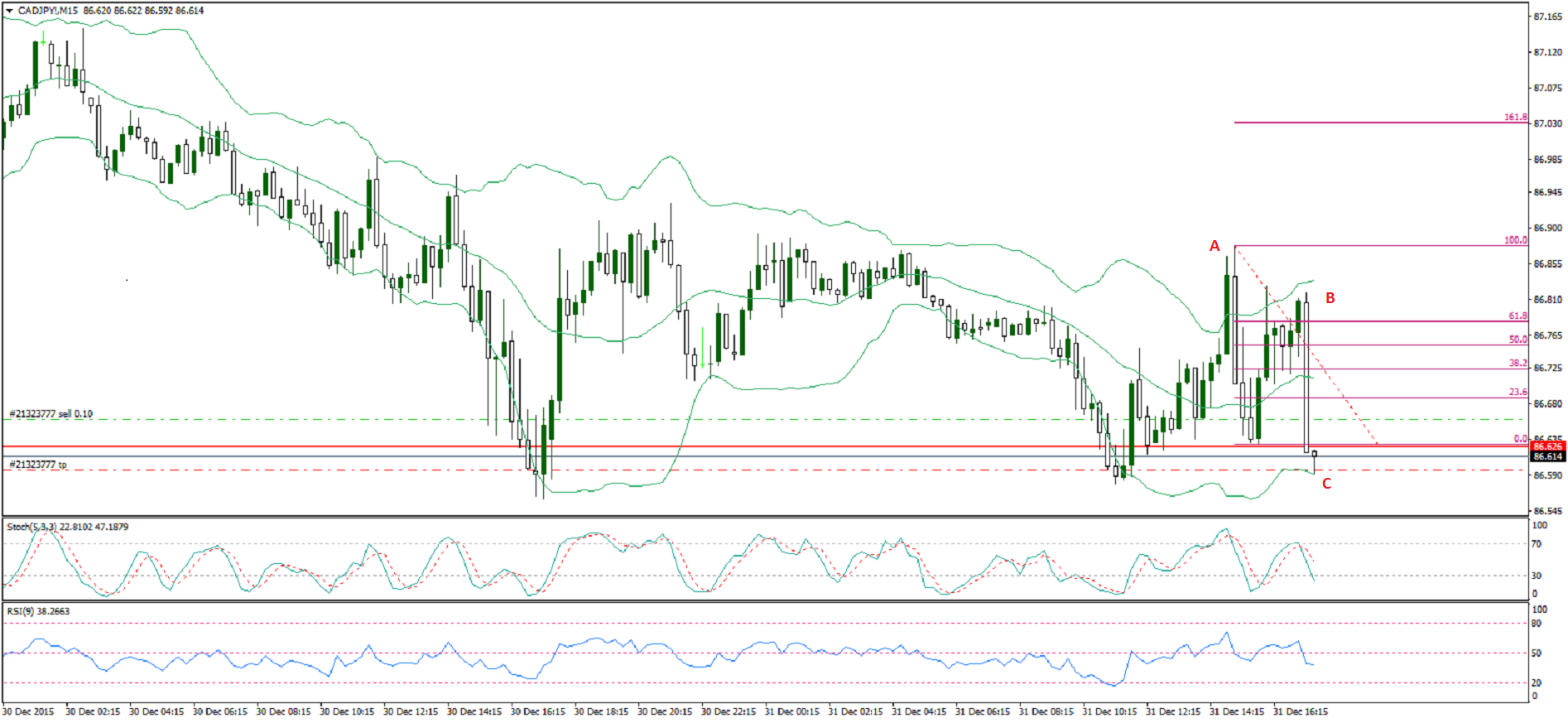

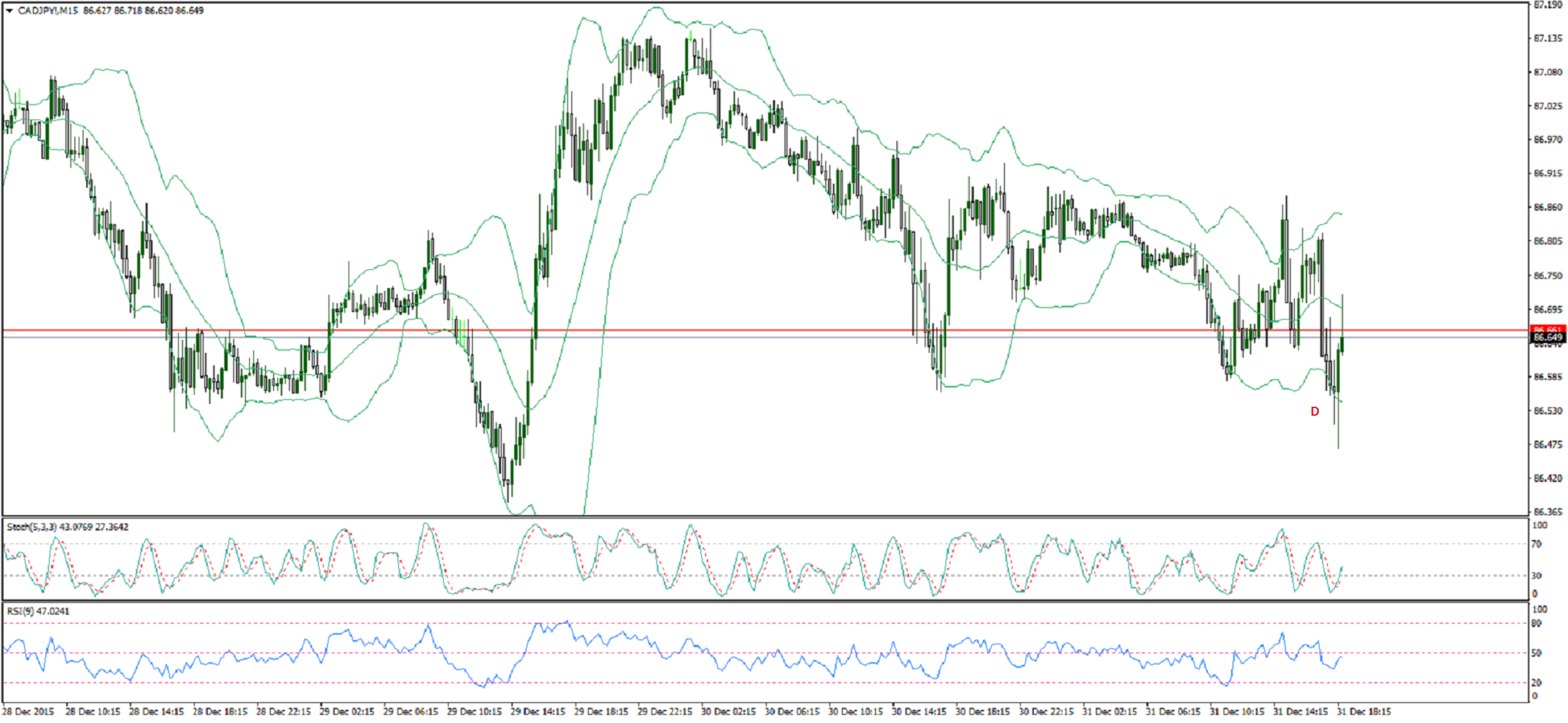

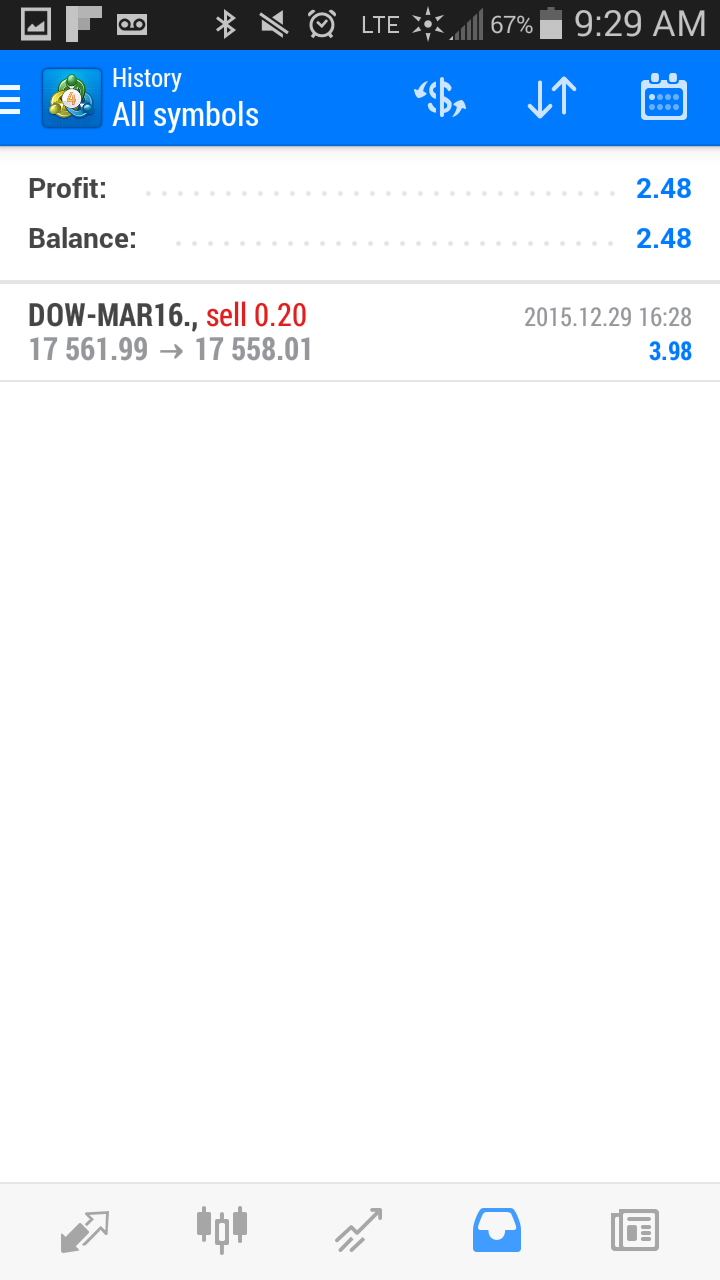

This trade yielded 189 points. There was a Fibonacci retracement drawn on a longer term time frame.

A short position was taken in anticipation of a trend line break. As happens frequently, price pushed higher after the trendline break, resulting in some sort of false breakout.

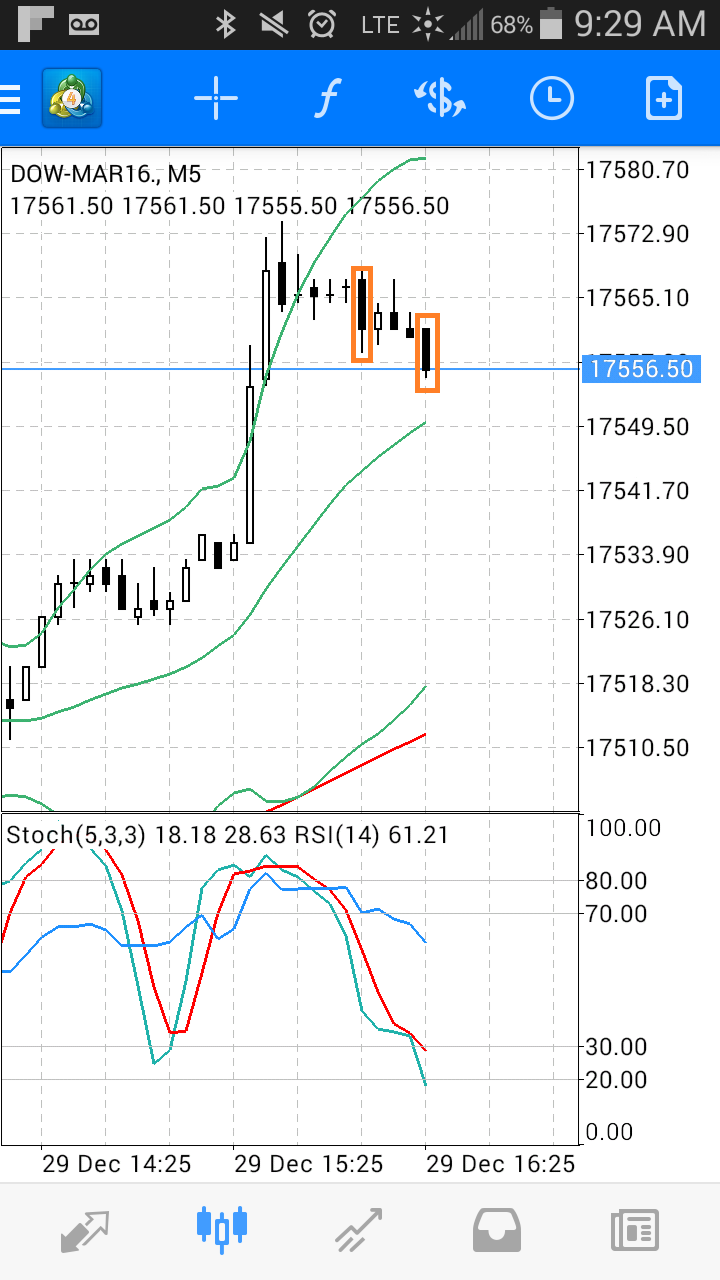

At a certain point while the trade was on, I placed a breakeven stop loss. Then I moved it to about +30 points. Then I exited manually. If you zoom out to a 5 minute chart, you’ll notice that price bounced around the area where there was a prior swing high.