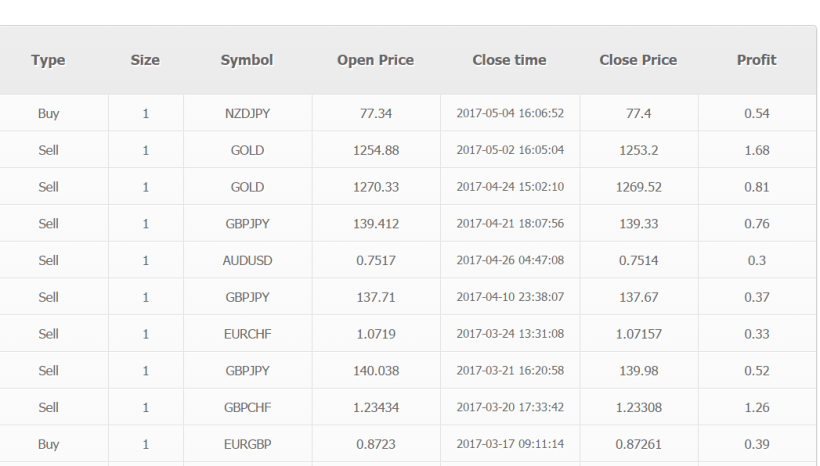

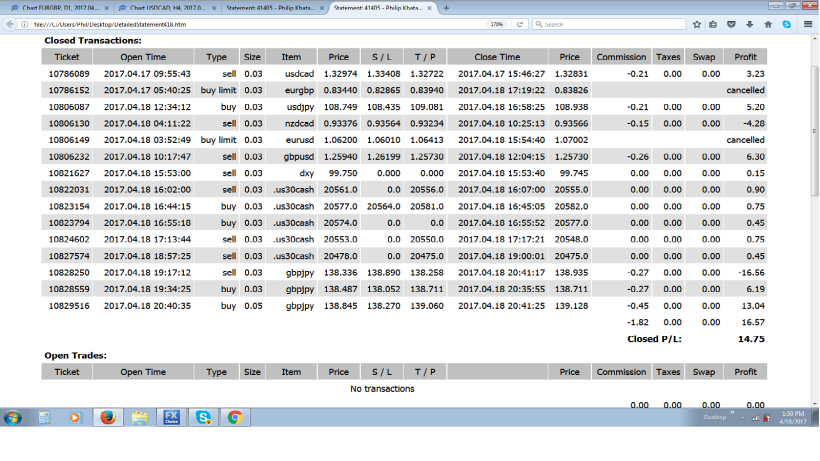

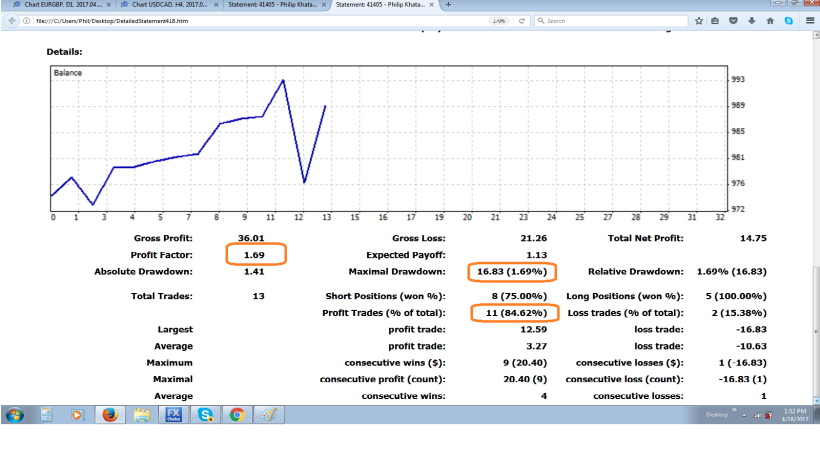

Here is an account which we are working on reviving from a drawdown. We must remind ourselves of the good pockets of performance and to be more consistent.

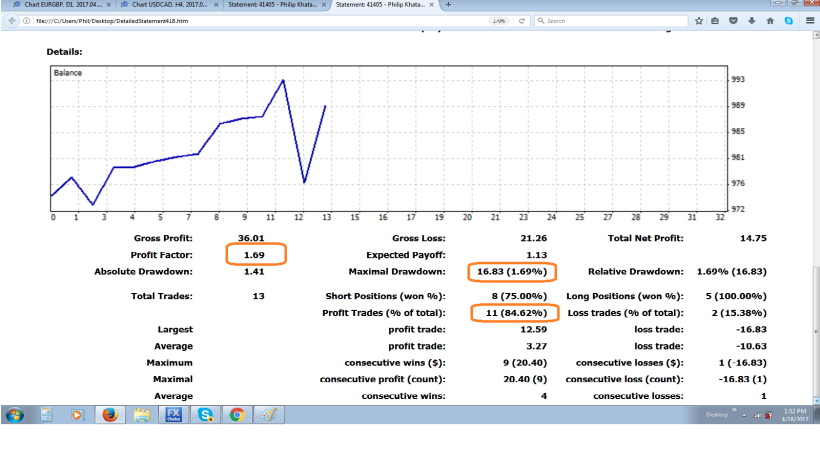

Are you reviewing Metatrader metrics? Note that they seem to define maximal drawdown as the largest losing trade (with commission added).

Also, I noticed a new feature related to exiting multiple orders. We need to be on the lookout for these kinds of things!

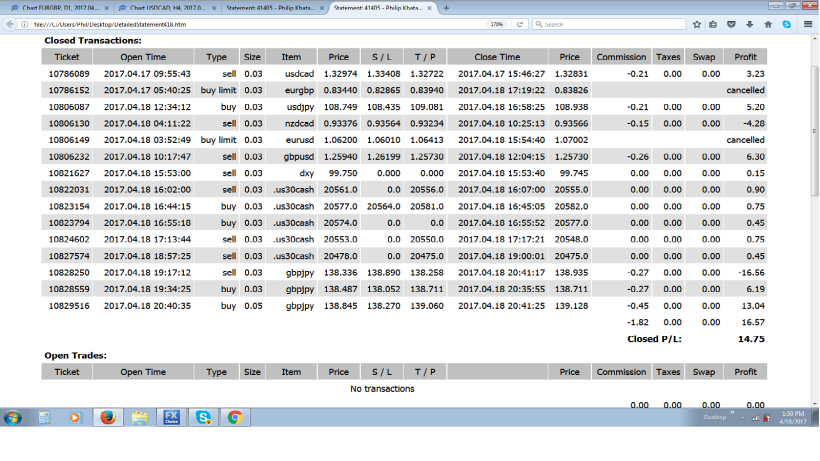

I was thankful to be able to trade the Dow today (5 profitable scalps 🙂 )

Using ball park figures, we can say this was a session that ended with +30 “points”.

There are nuances here:

- Pip values vary by pair

- Brokers / Platforms can handle commissions and ‘tick’ values differently than others, for CFD’s like Dow, and other instruments

Using our ball park estimate, 30 points could work out to be 300 dollars on standard sizes. This example was a live account with very small position sizes.

Be sure to understand the platform you are trading on. The Foreign Exchange Trading Academy delves into this subject in the new Risk Management curriculum.

Theoretically, you could gain positive pips or points, yet be in the negative due to position size management (and vice versa)!